Cooperatives offer communities a vital tool to build collective wealth; meet social, economic, cultural, and ecological needs; and boost local power. Yet federal support for cooperative small business development is extremely limited. In fiscal year 2024 alone, the US Small Business Administration approved 70,242 loans under the 7(a) guaranteed loan program to private small businesses, totaling more than $31 billion. By contrast, since 2020, there have been four 7(a) loans made to co-ops.

There is one federal program dedicated specifically to supporting co-ops: the Rural Cooperative Development Grant (RCDG) program, housed at the US Department of Agriculture (USDA). Funding for the program has remained stuck at $5.8 million—an annual allocation that works out to less than two cents per capita.

Over a third of Americans hold cooperative memberships in credit unions alone.

For that pittance, over the past decade RCDG has enabled co-op development organizations to provide specialized technical assistance, business support, education, and training to more than 8,000 cooperatives and mutuals in rural areas. It has supported the incorporation of more than 1,000 businesses and created or saved more than 17,000 jobs since 2015. This year, the administration of President Donald Trump has sought to zero out this modest allocation, though Congress appropriated full funding for the program for Fiscal Year 2025.

But in a society where traditional lending has never embraced co-ops and with existing limited federal support at risk, what options does the co-op movement have? In fact, co-ops have the means at their disposal to self-finance development. It’s time for people in the movement to realize that when it comes to financing co-op development, there is no place like home.

The Wealth of Co-ops

The layperson may think of cooperatives as scrappy. Even those within the co-op movement often operate through a lens of resource scarcity.

But the US co-op movement is large and powerful. Over a third of Americans hold cooperative memberships in credit unions alone—143.2 million people as of March 31, 2025. Many of those people are member-owners of multiple cooperatives, as the United States boasts more than 350 million co-op memberships.

All told, an estimated 30,000 co-ops generate more than $660 billion in revenue. A USDA-funded study from 2009 found that co-ops generated more than $25 billion in wages and held over $3 trillion in assets, numbers that are surely higher today.

This success, however, is not evenly experienced. In 2023, the 100 highest-grossing co-ops generated nearly $325 billion in revenue. Put another way, one-third of 1 percent of the nation’s estimated 30,000 co-ops account for nearly half of all co-op revenue.

The Co-op 100 list is frequently dominated by cooperatives in agriculture, finance, and energy. For instance, Land O’Lakes is number three on the list. Not coincidentally, these sectors—the most established US co-op sectors—when they were emerging were supported by federal policy. For example, the Capper-Volstead Act of 1922, which supports farmers to collectively market their products, has been described as the “Magna Carta of Agricultural Co-ops.”

A mutualistic fund would invite all cooperatives to meaningfully participate in sustaining the movement—and would enable co-ops that have flourished to pay it forward.

What Is a Mutualistic Fund?

A solidarity fund, also known as a mutualistic fund, is a financial institution devoted to the support of the cooperative movement that is funded by voluntary or compulsory contributions from cooperatives and are generally managed by an apex cooperative association.

Mutualistic funds arise from preexisting solidaristic attitudes and behaviors that acknowledge the interconnected nature of success and sustainability.

Italy’s fondi mutualistici are the most frequently cited example. Since 1992, under Law 59, the Italian government has mandated that all cooperatives contribute 3 percent of their annual net profits to one of five solidarity funds in the country, each associated with an apex cooperative association. As Andrea Bernardi and his research team detailed: “The funds’ exclusive mission is to contribute to the start-up of new cooperatives and to support those already existing, creating the conditions for the development of the cooperative movement, promoting initiatives to enhance cooperation.”

Although Italy’s approach represents a clear and successful implementation of solidarity funds, some version of this can be found in Canada, Spain, France, and the United Kingdom. Contributions to mutualistic funds could be compulsory (as in Italy) or voluntary (as in Canda), but the implementation of such a fund is usually preceded by the practice and ethos of external mutuality. Mutualistic funds arise from preexisting solidaristic attitudes and behaviors that acknowledge the interconnected nature of success and sustainability of the cooperative sector.

Solidarity for US Co-ops?

Could solidarity funds be implemented in the United States? What kind of funding could be unlocked, and what might compel US co-ops, so frequently siloed by sector, to contribute?

To answer these questions, I focused my research on the Co-op 100. I collected data from annual reports, financial statements, corporate social responsibility reports, 990s, websites, and interviews to determine:

- The capacity of the US cooperative movement to create a solidarity fund to support cooperatives and co-op development through loans, grants, training and education. How much funding could be available for this?

- The propensity of co-ops to give. Do practices of external mutuality already exist? What are cooperatives supporting, in what amounts, and why?

Capacity

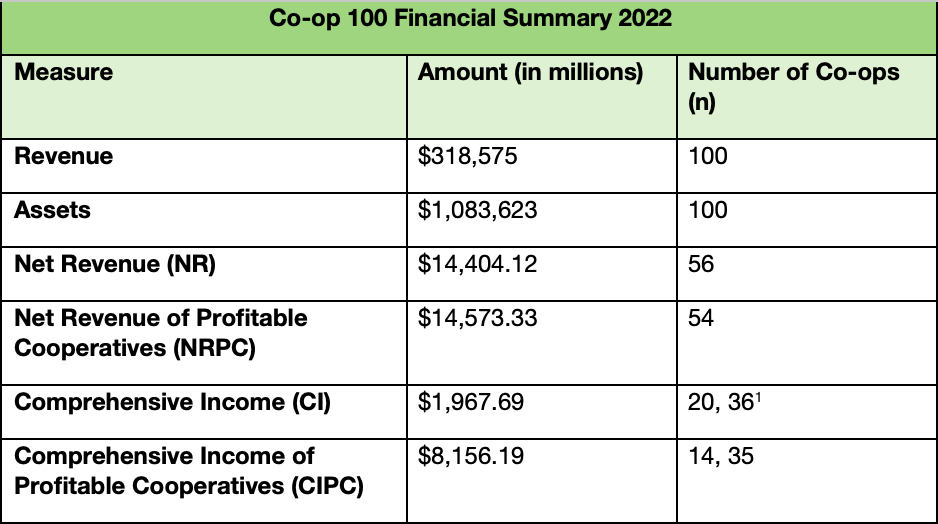

Unlike nonprofits, most cooperatives (which, with some exceptions, are for-profit) have no legal obligation to make their financial information public. As such, net revenue data were found for only 56 of the top 100 cooperatives. Some cooperatives also provide Statements of Comprehensive Income, which have been included as available.

Data collected revealed that 56 of the top 100 cooperatives collectively reported $14.4 billion in net revenue. When comprehensive income was used, this dropped to just under $2 billion. For a more accurate idea of the capacity, net revenue was also calculated with cooperatives posting net losses removed. This was done to more accurately reflect the practice of solidarity funds—cooperatives with net profits contribute, and those posting a loss do not. With this adjustment, net revenue in these two categories increased to $14.6 billion and $8.2 billion, respectively.

It’s clear that the US cooperative movement has the capacity to invest in itself. As federal support for cooperatives wanes, the question of propensity is critical.

Solidarity funds generally require just a small percentage of net profits be contributed. If US cooperatives adhered to Italy’s model of requiring a 3 percent contribution, just 56 of the top 100 co-ops would have contributed between $244 and $437 million to solidarity funds in 2022.

The United States is not Italy. But even if contributions of US co-ops were one-sixth of what Italy’s Law 59 mandates—just 0.5 percent of net profits—these cooperatives still would have contributed between $40 and $72 million, based on 2022 net revenue.

Propensity

It’s clear that the US cooperative movement has the capacity to invest in itself. As federal support for cooperatives wanes, the question of propensity is critical.

Past efforts exploring the potential of large co-ops to invest in the movement have focused on the return on investment of the fund. The hypothetical mutualistic fund proposed here would yield dividends to the co-op movement through creating new co-ops, growing existing co-ops, connecting value chains, supporting co-op education, and increasing awareness of the co-op model—but would not deliver direct financial returns to contributing cooperatives. For this reason, I focused my research on co-ops’ charitable giving trends and motivations.

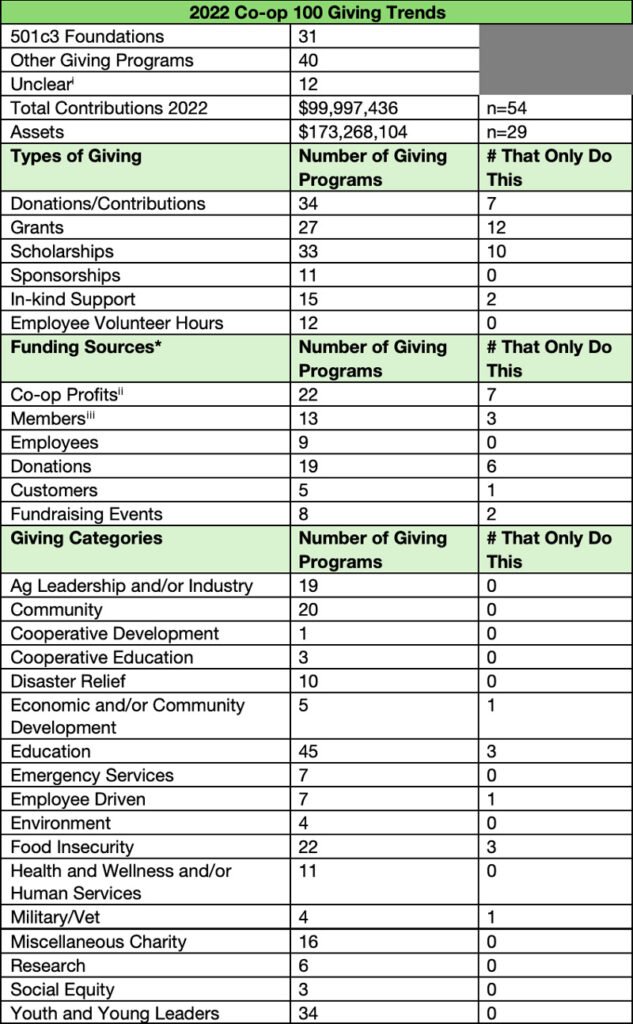

Co-op 100 co-ops made nearly $100 million in charitable contributions in 2022, although the actual total was likely higher because data could only be found for 54 of the 69 cooperatives determined to have 501c3 foundations or other giving programs. The three largest giving programs accounted for nearly half the contributions. Notably, only four of the Co-op 100 specifically contributed to cooperatives.

Barriers and Bridges

The quantitative data gathered on co-op charitable contributions was paired with interviews with five senior-level leaders with documented giving programs exceeding $50,000. Among other questions, these leaders were asked to identify barriers and benefits of contributing toward a mutualistic fund to support cooperatives.

The people I interviewed were frank about the siloed nature of US cooperatives. One interviewee stated, “That sense of solidarity that exists, let’s say in Italy or in the Mondragón Basque region, is absent here in the United States.”

That said, in discussing the benefits of supporting cooperatives, the philosophical and solidarity-oriented foundations emerged. One interview subject reflected, “There’s a real difference in the concept of ‘I exist to maximize a return to the shareholder’ versus ‘our existence is to solve a collective problem that our members had or continue to have.’”

One representative laid out their thinking of the benefits of supporting cooperatives as assessing it based on its importance to the economic system as a whole, to members, to the co-op itself, and whether support will create a resource that could solve further issues. There was also a recognition that co-ops supporting co-ops is simply good business. Building cooperative value chains, strong cooperative ecosystems, and greater recognition of the value of cooperatives can strengthen existing cooperatives.

Can Co-ops Get Moving?

We know that countries with strong co-op systems have robust, accessible cooperative financing mechanisms. Mutualistic funds provide a tested, effective path for the co-op movement to self-finance future growth.

Today co-ops, like nonprofits, face great uncertainty. For co-op development, the only consistent federal funding, meager though it is, may soon disappear. But might perilous times lead co-ops to embrace solidarity as a tool of survival and resistance?

As the old proverb goes, the best time to start a mutualistic fund for cooperatives was 30 years ago. The second-best time is now.